minority tax pros cost

Theres no federal sales tax and federal excise taxes accounted for just 3 of federal revenues in 2019 according to the Tax Policy Center. Well it used to be.

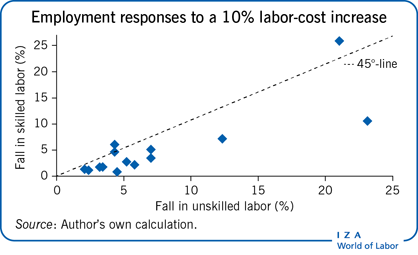

Iza World Of Labor Do Labor Costs Affect Companies Demand For Labor

You have to account for.

. We support them no matter where they stand on the growth curve - Priyanka Chopra CFO Ventures USA. Small business owners have more complicated tax obligations than people who earn wages as employees. Renting a Home vs.

Is community college free if you get a Pell Grant. 34 states currently have identification requirements while 7 have strict photo ID laws. Several pros and cons of living wage laws are worth considering.

Combine the states base sales tax rate. This too is a lot of tax. A living wage improves worker morale.

Exploring the world of money and the impact that money decisions have on our everyday lives has always been more than just a job for me. List of the Pros of Living Wage Laws. Once you sign and execute the will you do not need to do anything else unless you want to make changes to it in the.

Pros Cons and How It Compares. So what about two-year colleges. Ive been obsessed with personal finance for more than 15 years now.

Betterments goal-oriented tools and helpful tax strategies should appeal to investors of all types. Out of the 75 counties in total 68 of them see homeowners with an annual payment of less than 800. The other four packages each cost 399 for a 60-minute.

With official forms of identification costing more than 100 in some areas it can be costly to exercise this right. However the federal government is far less reliant on consumption taxes than most states. Because the states sales tax rate is high too.

Instructions for Form 1040 PDF Tax Table from Instructions for Form 1040 PDF Schedules for Form 1040 Form 1040-SR PDF. Tom Cruise Arye Gross Jessica Harper Patrick Kilpatrick Caroline Lagerfelt Neal McDonough Kathryn Morris Tim Blake. When you start living in Arkansas then you will discover that the annual property tax payment is significantly lower than the national average.

US Individual Income Tax Return Annual income tax return filed by citizens or residents of the United States. Compare that to 1973 when a Pell Grant covered over 75 percent of the cost according to the Lumina Foundation. Buying a home is a huge part of the American DreamChoosing to buy or rent though is a major decision that affects your financial health.

The problem with many voter ID laws is that they serve as a poll tax without being called one. Block Advisors small business certified tax pros and the Urban League of Greater Kansas City ULKC are helping Black-owned businesses Small Business Tax Prep 5 reasons to file small business back taxes. With the additional amount local municipalities can add on.

A couple in the minority. And you will see rates pushing 7 on your purchases. Letter to a New Minority City Lights Open Media Paperback January 10 2012 by Tim Wise Author 46 out of 5 stars 323 ratings.

Pros and Cons A will is a legally binding declaration by a person called the testator that after his death his estate will distribute his assets in a specific way. Or closer by New Hampshire. The benefit of a will is that creating one is low-cost.

The finance function at our companies ranges from a single person starting to build out a team and processes to an established team looking for guidance on international tax compliance and rolling forecasts to support business growth. The statewide median is only 063 which makes it the tenth-lowest rate in the country. But the Lumina Foundation says that a Pell Grant only covered about 60 percent of the cost of attending community college in 2013.

Think about a state like Oregon. The first minimum wage was set by the Fair Labor Standards Act in 1938 as part of the New Deal project to protect workers. Minority Report Blu-ray.

It also banned child labor and limited the working week to 44 hours. The CBOs projections put expected cannabis tax revenues at approximately 14 billion per year.

Amazon Overcoming Educational Racism In The Community College Creating Pathways To Success For Minority And Impoverished Student Populations Innovative Ideas For Community Colleges Series Long Angela Bumphus Walter G 9781620363485 Books

2020 Tax Software Survey Journal Of Accountancy

Obstacles To Implementing The Rights Of Minorities And Early Effective Conflict Prevention Minority Rights Group

Tax Breaks For Minority Owned Businesses

The Race Card From Gaming Technologies To Model Minorities Postmillennial Pop 22 Fickle Tara 9781479805952 Books Amazon Com

2020 Tax Software Survey Journal Of Accountancy

2020 Tax Software Survey Journal Of Accountancy

Amazon Com The Black Tax The Cost Of Being Black In America Ebook Rochester Shawn D Books

:max_bytes(150000):strip_icc()/dotdash_Final_How_To_Calculate_Minority_Interest_Oct_2020-01-54830679f6a34b8581810db05d008661.jpg)

How To Calculate Minority Interest

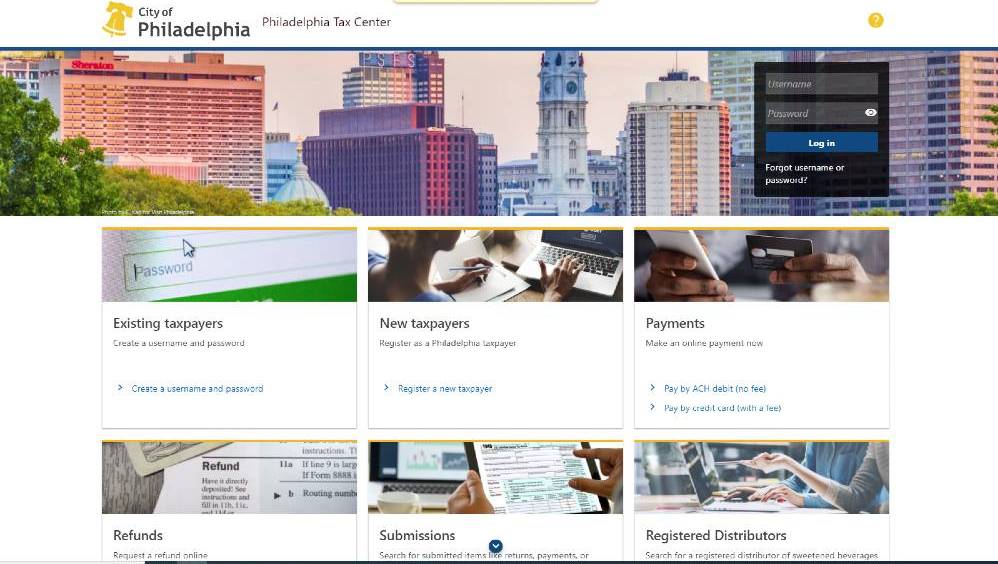

Log In To The Philadelphia Tax Center Today Department Of Revenue City Of Philadelphia

How The U S Tax System Disadvantages Racial Minorities The Washington Post

H R Block S Newsroom Source Of Company And Tax News H R Block

The Time Tax Put On Scientists Of Colour

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Consolidated Group Tax Allocation Agreements The Cpa Journal

Consolidated Group Tax Allocation Agreements The Cpa Journal

29 Crucial Pros Cons Of Taxes E C

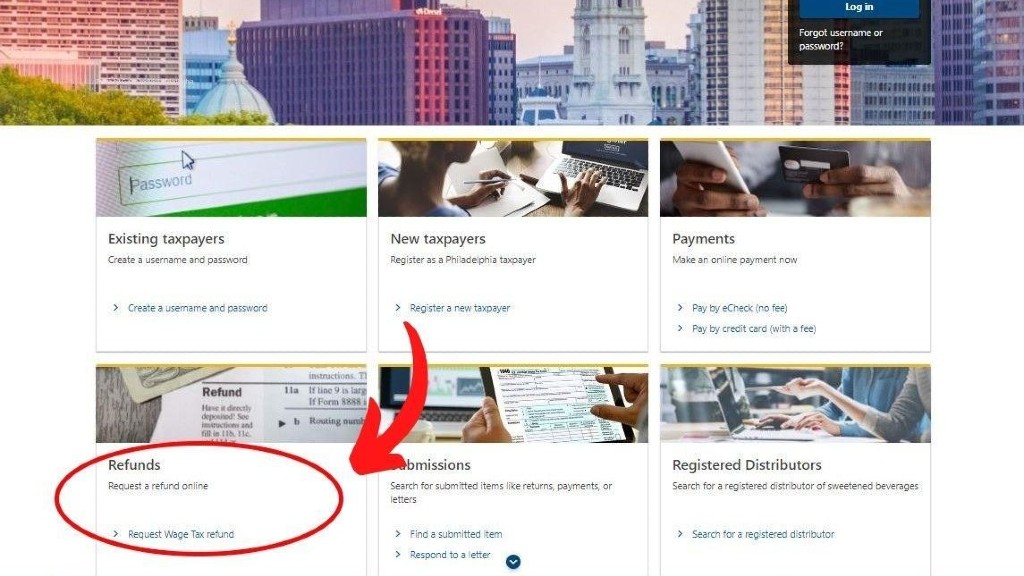

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia